Brookfield Real Estate: Narrative Disconnect

Markets including San Francisco and London provide an alternative and much less rosy view of Brookfield's real estate than presented to investors by management.

Brookfield’s most recent mantra characterizes the current real estate environment as a tale of two cities – one suffering and one outperforming. As you might imagine, according to management, Brookfield owns the outperforming type of assets.

To wit, Brookfield Corporation’s (BN) 2Q23 letter to shareholders states:

“Our real estate business continues to benefit from strong tenant demand for space in high-quality, well-located buildings and shopping malls, with our core portfolio 96% leased. Recent leasing momentum has driven higher revenues in this core portfolio, resulting in growth in net operating income of 8% compared to the prior year”

The one-sided optimism runs counter what is going on in large swathes of the real estate market. Some of the issue is semantic, definitional. Management speaks not of all property but of “core” properties. What is core? Well, as The Real Deal noted in its recent investigation on Brookfield, core can have a shifting meaning, and no one tells you when it changes or why.

Take San Francisco, for example. Older BPY documentation list San Francisco assets as core. The 4Q18 supplemental package lists four assets in the city: One Post Street and 685 Market Street were both listed as core office. Stonestown and One Union square were listed as core retail properties.

San Francisco’s problems are no secret. The rapid decline of the city is triggering general commercial property distress. This article notes that cellphone activity is only 29% of pre-pandemic levels, suggesting the city has been to some extent abandoned. Local media cites a Boston Consulting Group report stating that commercial real estate values are down by as much as 60%. Not surprisingly, landlords are looking for tax cuts.

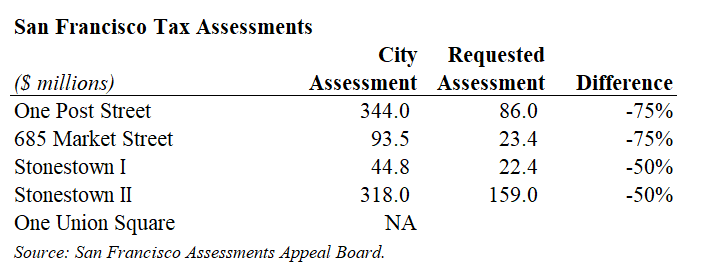

One article discussing tax assessments provides a link to a city service showing current assessments and changes requested by building owners. We queried the database for Brookfield properties to see current assessed values and requests for changes. They are shown in the table below.

We found three of four. Brookfield is requesting that tax assessment valuations be taken down -50-70%, in line with the general market rout noted by BCG.

I have no doubt the assets are troubled and believe Brookfield thinks the write-downs are warranted.

Is the performance of these assets included in the fine core real estate performance cited in BN’s 2Q23 letter? I doubt it, but who knows? San Francisco is no longer mentioned in BPY filings.

San Francisco is not alone in being ignored. London’s still core Canary Wharf has not been a topic of conversation recently, despite making headlines worldwide. Canary Wharf is likely Brookfield’s single largest real estate asset with a carrying value of $3.2B as of 4Q22.

Canary Wharf has faced an identity crisis since the pandemic. Long a financial hub, the huge real estate complex has tried to diversify, adding housing and life sciences to the mix. It is a long process that has yielded mixed success.

HSBC recently announced it will leave Canary Wharf when its lease expires. HSBC occupies an important Canaary Wharf property, a prominent 40-floor building (owned by the QIA). The HSBC tower and its ~8,000 employees will retreat from the Docklands back to the City, cutting office space 40% in the process.

HSBC’s departure is a big deal for Canary Wharf that garnered a lot of press coverage. Efforts to modernize the estate with the “live, work, play” strategy, it is still primarily a very large office complex located away from London proper. Large financial firms and their employees are its lifeblood. Without them, all else withers.

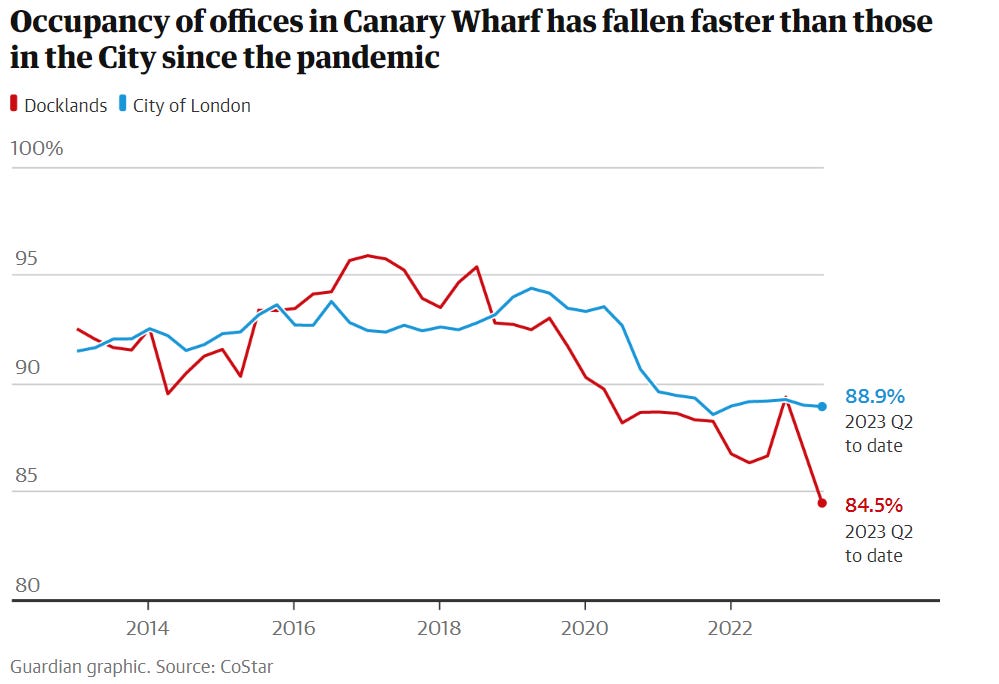

This longish article from the Guardian describes HSBC’s move as a “hammer blow to Canary Wharf’s standing as a global financial center”. It also details the complex’s many other woes. At the core of all problems is the declining office occupancy depicted in the chart above.

Canary Wharf’s troubles have not gone unnoticed by Moody’s, which downgraded the group’s debt to Ba3 at the end of May 2023. The two notch downgrade to very deep junk for one of Brookfield’s core, trophy assets is not a good sign. Moody’s notes the weak credit metrics, high refinance risk and reliance on asset sales in a difficult environment to repay debt.

Management is making a concerted PR push, touting the strength of the real estate platform. However, a growing number of markets that now include LA, Washington, San Francisco and London suggest there is another side of the story that isn’t being told - core or not.