Is Brookfield's Flagship RE Vehicle on its Way to Junk?

S&P puts Brookfield Property Partners on CreditWatch. A mention of a Brookfield private fund and language suggesting a “negotiated settlement” pique my interest.

The mention of financial distress is not a welcome topic of conversation in the polite and sometimes seemingly faith-based world of Brookfield investors. Even as Brookfield Property Partners (BPY) slowly imploded over the last several years, few in the mainstream investment community or media commented. Finally, S&P ratings has said the unmentionable out loud, though they did so in a nice way that allows management sustain their narrative.

On October 5th, S&P put BPY on CreditWatch due to weaking credit metrics. BPY is currently rated BBB-. If S&P goes through with the downgrade, Brookfield’s flagship real estate company will be junk rated.

The note mentions – the fixed charge coverage declined below 1x with no near-term improvement expected, heightened refinancing risk, and an eyewatering Debt/EBITDA ratio of 17.3x. None of this is surprising to me. I wrote about BPY’s financial distress when it was still public and vulnerable to a downward spiral, from which it was saved by a BAM buy-in. But there were a few interesting elements of S&P’s report, including this:

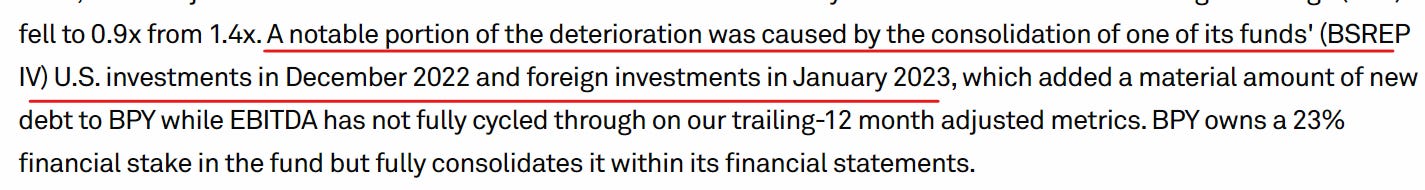

Outtake from S&P Note

Source: S&P.

In this case, we appear to have all the debt, but not all the cashflows yet for BSREP IV, which is consolidated.

BSREP IV is a 2021 fund. BAM does not yet provide returns for the fund, but I expect it will be a difficult vintage.

One BSREP IV purchase is Alstria Office REIT, a German company. Brookfield tendered for the pubic REIT at Euro 19.50 per share. A stub portion remains public and trades for Euro 3.42.

S&P notes that the full contribution from BSREP entities are not yet included in the trailing 12-month numbers. However, if Alstria’s recent performance is any indicator, it is questionable how much it will improve. The exhibit below show’s Alstria’s recent performance.

Alstria Office Recent Performance

Source: Company filings.

Although revenue is largely flat, profits and funds from operations are down -80.6% and -19.5%, respectively.

I have long maintained that BPY should be viewed as a window into performance at BAM’s private real estate funds. S&P’s commentary is the first I have seen explicitly noting the impact of the consolidation on BPY’s financials.

The purchase of Altria is reminiscent of the GGP purchase just before the retail apocalypse.

The other interesting aspect of the S&P note was the way in which it discussed what looks like financial distress.

BPY does not report defaulted debt. As S&P states, BPY has “suspended payment” on 3% of debt. Brookfield does not define what debt. Using total consolidated debt of $67.6B yields to defaults of around $2B.

With respect to suspended debt payments, the notes says “we view this as a portfolio management exercise, not a default”.

When noting “rapidly deteriorating coverage metrics”, S&P also “acknowledges BPY’s sizable liquidity position…”

In my view, this language reads like a negotiated settlement between S&P and the company paying for them to write the report. Things had deteriorated to the point where some of the negatives had to be said out-loud and publicly acknowledged. At the same time, however, mitigations were offered.

Real estate is a long cycle. We likely have a ways to go before the Brookfield RE story fully plays out.