Superlatives over Substance

Management discussed key BIP asset BUUK Infrastructure on the 3Q23 call without citing a single, verifiable number. Does management have a reason to avoid detail? We think so.

(Read the important disclaimer at the end of this piece in which we state we are not giving investment advice and encourage readers consult the licensed professional analysts that follow the partnership for sell-side investment banks.)

Our first piece on BUUK Infrastructure included in our larger BIP report (available here) seems to have struck a chord with investors. Soon after publication, Brookfield head of infrastructure and BIP CEO Sam Pollock discussed BUUK on the 3Q23 call at length in an apparent attempt to assuage investor concerns. It is the first time the asset has been discussed so extensively in public. However, while investors lacking context may have been reassured, we found the incremental disclosure troubling.

Mr. Pollock’s commentary lacked detail, instead his bullish sentiment was garbed in what we consider calculated financial obscurity. Although a substantial portion of the call devoted to BUUK, Mr. Pollock discussed the financial history and growth of what he termed “one of mine and the company’s favorite businesses” without using a single verifiable number from BUUK’s financial statements. No revenue, no income, no cash flow from operations. Mr. Pollock stuck to superlatives and percentage growth rates for non-GAAP metrics.

This piece puts Mr. Pollock’s comments into the context of BUUK’s actual 2023 financial results, giving investors the opportunity to compare management’s public statements with financial realities.

In the analysis, we show how Mr. Pollock’s narrative of BUUK’s “tremendous decade long 20% annual FFO growth” presumably supporting the purported ~$4B valuation is built on what we view as half-truths.

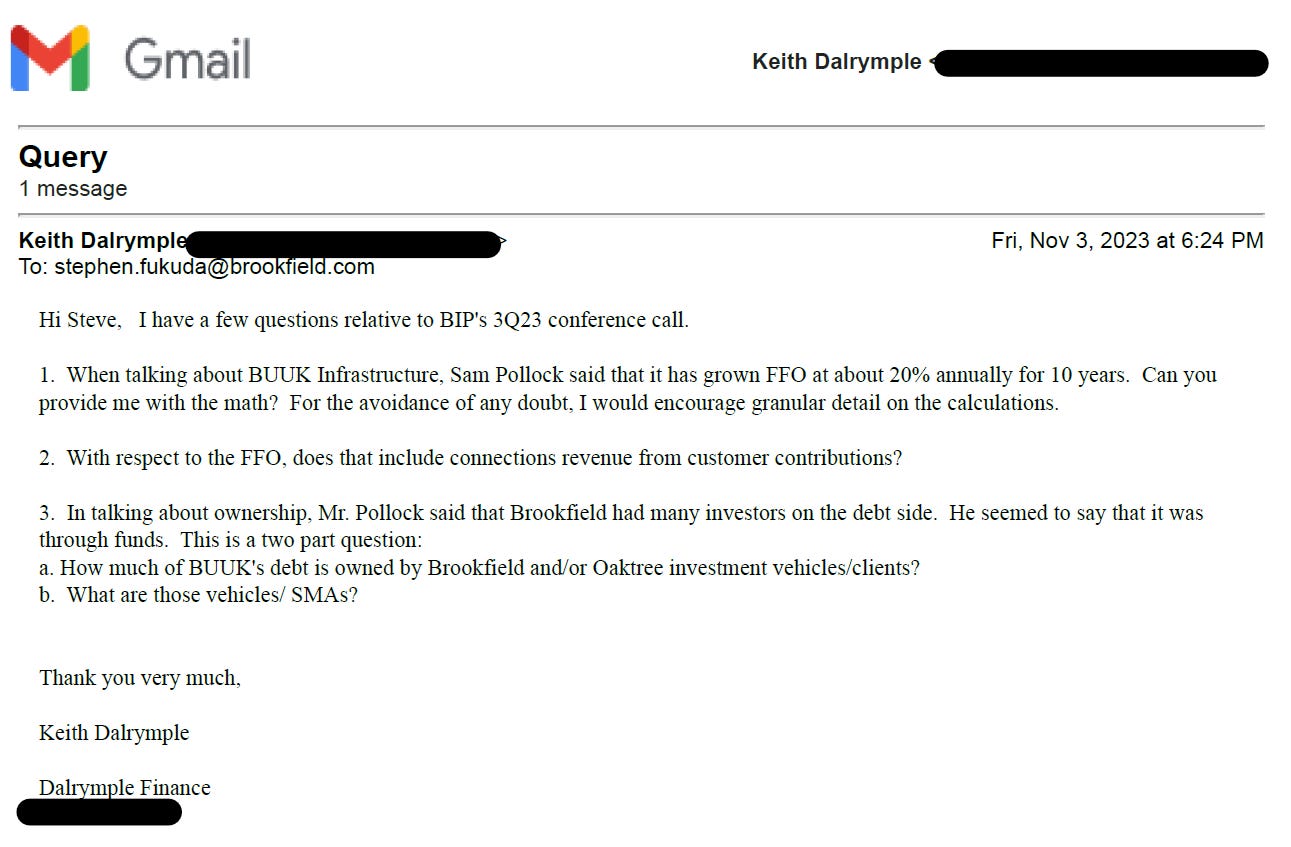

We wanted to make sure we got the analysis right, so we emailed BIP several simple questions to clarify key issues. We sent the same email twice, which is shown in the appendix. The partnership failed to respond.

Management has had three opportunities to correct the partnership’s portrayal and disclosure of BUUK’s business model – following our original report, on the call when queried, or through our email correspondence – but has not done so. In our view, if transparency would debunk our core thesis that BUUK’s FFO is vastly inflated, management would have likely provided the necessary detail. Instead, investors got vague claims of “tremendous growth” and assurances that BUUK is one of management’s “favorite businesses”.

Core of the Thesis: Cash Flow Mirage

BUUK Infrastructure Holdings is a long-held, important asset that accounted for 11.9% of the partnership’s net asset value and ~7% of FFO as of 2023. Over the years, BUUK has contributed hundreds of millions of FFO to support distributions to BIP unitholders.

BUUK has two businesses: it constructs “connections”, that is infrastructure to connect gas, electricity, water and the like. BUUK also owns the networks it constructs and collects a fee for the service. We believe constructing the networks is loss-making and has no value to third-parties as a stand-alone business.

The pipeline network business generates recurring revenue. Networks are tradable assets and the sole determinant of company value, in our view.

Management seems to conflate the two businesses when speaking of BUUK. In our view, conflating the them helps obscure the true cashflows of the business. We believe BIP treats customer contributions to CapEx construction as revenue, which artificially inflates BUUK’s FFO and cash flow metrics. This not only makes BUUK appear much more profitable from a cash flow perspective, but hides the fact that the profitability of the pipeline segment, which is the only asset of value to third-parties, has collapsed over time.

After adjusting BUUK’s finances for the unusual revenue recognition policy:

· Cash flows are a fraction of what are reported, because both IFRS and proprietary cash flow metrics are inflated by treating CapEx contributions from customers as revenue. We estimate that in 2023, BUUK’s economic FFO was £38M 82% less than the £212M recorded on BUUK and BIP’s financial statements.

· BUUK is overvalued by 2-3x. Adjusting EBITDA for the accounting anomaly, BIP carries the asset at an EV/EBITDA of ~33x in an industry that trades ~12x.

Focus on Construction: Optics are All

On the 3Q23 call, management was queried on BUUK Infrastructure. The analyst asked about the state of U.K. homebuilding market and for management’s long-term perspective of the business. The question gave Mr. Pollock the opportunity to launch into a long segment on the company

Mr. Pollock said of U.K. housing starts that although down ~20%, he emphasized that BUUK will construct more connections this year than last, due to the backlog. Focus on the construction side of the business is peculiar given it is the pipeline segment that generates value. However, construction is important for two reasons: a larger network should generate recurring revenue cashflow growth, all things equal; and importantly, construction creates the appearance of high FFO growth, though the free cash flow margins are ~0%.

We believe the contributions are largely expense free on the P&L, seemingly generating 100% EBITDA/FFO margins. However, ~100% of the contributions are expensed below the operating line as an investment on the cash flow statement, making the actual free cash flow margin 0%.

BUUK is not audited by Deloitte’s Infrastructure Group as one might expect, but a technology focused auditor out of a satellite office. Given he signs-off on the revenue recognition policy, we take it to be legal. That said, we consider the treatment of connections revenue to be fundamentally deceptive to BIP unitholders. We believe that as a CapEx contribution, connections revenue will never be cash available for discretionary purposes such as the payment of distributions. Yet, at the BIP level management presents FFO as a proxy for distributable cash flow. There is no way BIP unitholders could understand the deeply problematic quality issue with BUUK’s cashflows from BIP disclosures.

Generalizations Sound Good

In discussing cashflows, Mr. Pollock said that the business had exhibited “tremendous growth”, “(FFO) has been growing about 20% per annum over the last 10-years”. Astoundingly, throughout the entire discourse on BUUK’s financial performance, Mr. Pollock did not provide any hard, verifiable numbers.

Exactly what that 20% FFO growth trajectory looks like was left to investors’ imagination. For context, 20% for a decade would generate a 6x return, turning $100 into $619. We think the natural conclusion for investors doing the math based on Mr. Pollocks commentary would be that growth is huge and therefore Dalrymple Finance’s concerns with cashflow unwarranted. In our analysis, this conclusion is wrong.

The light-colored segment in chart below shows BUUK’s accounting FFO, which includes zero margin connections income, while the dark segment shows economic FFO, which is largely recurring revenue from the pipeline segment. Cashflows associated with smart meters have been removed from both.

Accounting FFO colored in gray grew at 17%, close to the stated 20%, from £41M to £212M.

In 2023, accounting FFO included £161M of connections revenue or customer contributions, meaning 76% of accounting FFO was customer contributions to CapEx. This is what BIP consolidates on its IFRS statements and presumably the Non-GAAP/IFRS FFO metrics as well.

We assume Mr. Pollock refers to accounting FFO when discussing the business, given that is what is recorded on BIP’s financial statements. It is also optically the most impressive if one doesn’t understand what it contains.

Mr. Pollock also said he “liked the business”, due to its “perpetual asset base with inflation-linked, and highly diversified regulated cashflows.” The perpetual asset base is the recurring revenue pipeline business, which is captured in economic FFO. If Mr. Pollock is so enamored with the regulated cash flows, why didn’t he disclose specific numbers and discuss them?

Economic FFO, which generates real returns, grew at 21% per annum over 10-years to 2022, the latest statements at the time of Mr. Pollock’s commentary, but the growth was from a tiny base of £6M to a still very small £42M. Using 2023 numbers, FFO actually declined over the 10-year period.

The lack of FFO growth despite the significant investments in new connections stems from the collapse in gross margins from 75% to 54% over the period shown. Describing revenues as diversified, inflation-linked and regulated implies stability and growth, in our view, but the reality is different as is clearly evident in pipeline segment results.

We can’t be sure if Mr. Pollock’s “tremendous decade long 20% annual FFO growth” referred to accounting or economic FFO – the statement could apply to both, and both are misleading without further detailed disclosure, though for different reasons.

Mr. Pollock stated that he had a recent valuation by a Big-4 firm valuing BUUK at nearly $4B, which is close to the 2022 year-end carrying value.

While we don’t doubt that Brookfield commissioned a Big-4 firm to value BUUK and the resulting valuation confirmed the LP’s carrying value, it doesn’t make it so.

BIP’s 2023 carrying value for BUUK is an enterprise value of $4.4B, which implies an EV/Economic EBITDA of 32.8x. These businesses trade reliably at 10-13x. Even at a premium multiple of 15x, BUUK has negative equity.

Conclusion: Don’t Look Too Closely

In our experience, when management teams have a good business model, they use detailed disclosure of factual information to persuade investors of value. BIP’s management has done the opposite with BUUK. Management has had numerous opportunities to publicly discuss the important differences between the construction and pipeline businesses, as well as disclose BUUK’s revenue recognition policies and its impact on IRFS cash flows and BIP’s non-GAAP/IFRS metrics. We believe that if transparent, detailed disclosure would debunk our thesis of inflated cash flows, they would likely have provided it.

APPENDIX

DISCLAIMER

This report represents the opinions of Keith Dalrymple and Dalrymple Finance on BUUK Infrastructure, an asset owned by Brookfield Infrastructure Partners. It is an opinion piece and should not be taken as investment advice of any kind. This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

BIP’s webpage provides the names of sell-side analysts and firms that provide research coverage. The firms and analysts listed are in the business of providing investment advice to individual and institutional investors. We strongly encourage those seeking investment advice to consult one or more of the sell-side research firms listed.

The report is based on publicly available information and due diligence Dalrymple Finance believes to be accurate and reliable. However, it is presented “as is” without warranty of any kind, whether express or implied. Dalrymple Finance makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. This report contains a large measure of analysis and opinion. It is subject to change without notice.

Following the publication of this report we intend on continuing to transact in the securities related to BUUK. We may be long, short or have no position at any time. That position may change at any time.

We are investors with the goal of profiting from our research. You should assume that as of the publication date, that Dalrymple Finance, Keith Dalrymple and/or affiliates have a position in related securities. We and affiliates have a vested financial interest in entity discussed in this report.

In no event shall Dalrymple Finance or Keith Dalrymple be liable for any claims, losses costs or damages of any kind, including direct, indirect and otherwise, arising out of or in any way connected with information in this report.

Good job Keith! Will we also see you again in the Alpha Investor Forum?